GUIDE

Structured Investment Vehicle: The Ultimate Guide

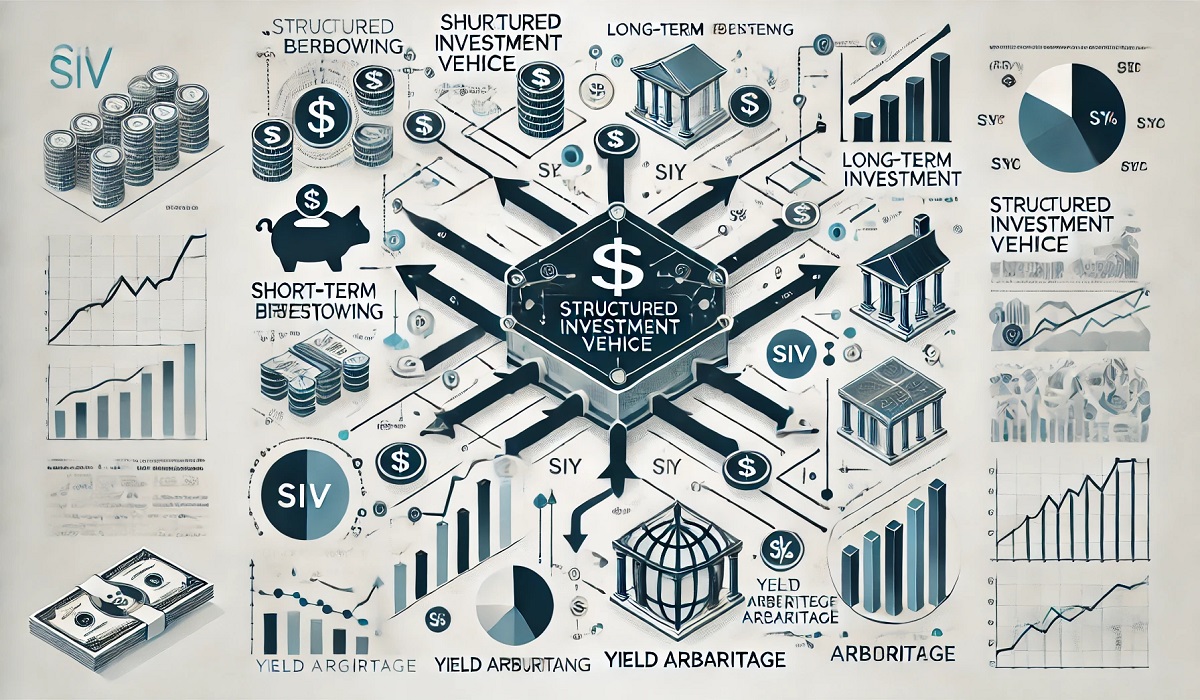

Structured investment vehicles (SIVs) are innovative financial tools designed to optimize returns while minimizing risks. This comprehensive guide explores the purpose, structure, advantages, risks, and implications of SIVs in global financial markets.

What is a Structured Investment Vehicle?

A structured investment vehicle (SIV) is a specialized type of financial entity that engages in arbitrage by investing in long-term assets funded by short-term liabilities. First introduced in the 1980s, SIVs became widely recognized during the mid-2000s due to their role in the global financial market.

SIVs generate profit through interest-rate spreads. They borrow money at lower short-term rates and reinvest it in higher-yielding, long-term securities like asset-backed securities (ABS) and mortgage-backed securities (MBS). Their complex structure enables them to earn substantial returns, although they are not without significant risks.

How Does a Structured Investment Vehicle Work?

Understanding the inner workings of a structured investment vehicle requires breaking down its essential components:

- Funding Sources: SIVs primarily rely on issuing short-term commercial paper and medium-term notes to generate funding.

- Investments: The funds raised are invested in high-quality, long-term securities, such as AAA-rated bonds or mortgage-backed securities.

- Yield Arbitrage: By capitalizing on the spread between short-term borrowing costs and long-term returns, SIVs aim to profit from interest-rate differentials.

Key Features of a Structured Investment Vehicle

SIVs operate with unique characteristics that differentiate them from traditional financial entities:

- Off-Balance-Sheet Status: SIVs are usually independent entities and do not appear on the sponsoring institution’s balance sheet, reducing regulatory oversight.

- Leverage: High leverage ratios, often exceeding 10:1, amplify potential returns but also increase risks.

- Diversification: Investments span a broad array of securities to mitigate risks and maximize returns.

Advantages of Structured Investment Vehicles

Despite their complexity, structured investment vehicles offer numerous benefits to investors and financial markets:

- High Returns: The yield arbitrage strategy enables significant profit potential.

- Portfolio Diversification: Investing in SIVs provides exposure to diversified assets.

- Innovation in Financing: SIVs offer creative ways to access and allocate capital efficiently.

Risks Associated with Structured Investment Vehicles

While the potential for high returns is attractive, SIVs are fraught with risks:

- Liquidity Risk: SIVs depend on continuous access to short-term funding, which can dry up during market stress.

- Market Risk: Fluctuations in asset prices can erode the value of investments.

- Credit Risk: A downgrade in asset ratings can affect the SIV’s ability to generate profits.

- Systemic Risk: SIV failures can have ripple effects, as observed during the 2007–2008 financial crisis.

Role of Structured Investment Vehicles in Financial Markets

SIVs have played a dual role as innovators and disruptors in financial markets:

- Innovation in Asset Management: By pooling investments, SIVs create opportunities for diversified portfolios.

- Influence on Liquidity: SIVs contribute to market liquidity through active buying and selling of securities.

- Market Challenges: During the financial crisis, SIV collapses highlighted vulnerabilities in structured finance.

Key Players in the SIV Landscape

Structured investment vehicles often involve multiple stakeholders, including:

- Sponsoring Banks: Large financial institutions that create and manage SIVs.

- Investors: Institutional and high-net-worth individuals seeking exposure to diversified assets.

- Credit Rating Agencies: Assessing the quality and risks of SIV-issued securities.

Structured Investment Vehicle vs. Special Purpose Vehicle

Although similar in purpose, SIVs differ from special purpose vehicles (SPVs):

- Leverage Levels: SIVs typically employ higher leverage compared to SPVs.

- Purpose: SIVs focus on arbitrage opportunities, while SPVs are often established for risk isolation.

- Investment Horizon: SIVs are designed for short-term funding, whereas SPVs may have broader investment objectives.

How the Financial Crisis Impacted Structured Investment Vehicles

During the 2007–2008 financial crisis, SIVs faced immense challenges due to:

- Funding Shortages: The collapse of liquidity markets restricted their ability to refinance short-term debt.

- Asset Devaluation: Declining asset values led to significant losses.

- Regulatory Scrutiny: Post-crisis reforms aimed to address systemic risks associated with off-balance-sheet entities.

Steps to Evaluate a Structured Investment Vehicle

Before investing in SIVs, consider these steps:

- Analyze the Portfolio: Assess the quality and diversification of the underlying assets.

- Review Credit Ratings: Check the ratings of issued securities and underlying investments.

- Understand Leverage Ratios: Evaluate the level of financial risk.

- Monitor Market Trends: Stay informed about macroeconomic factors affecting interest rates.

Best Practices for Managing Structured Investment Vehicles

To ensure effective management of SIVs, follow these guidelines:

- Adopt Risk Mitigation Strategies: Diversify assets and maintain adequate liquidity buffers.

- Enhance Transparency: Provide regular updates to investors regarding portfolio performance.

- Strengthen Oversight: Implement robust governance structures to monitor risks.

The Future of Structured Investment Vehicles

While SIVs have faced setbacks, their innovative approach to asset management continues to hold relevance. Advancements in technology and stricter regulatory frameworks may enhance their resilience and adaptability in evolving financial markets.

Pros and Cons of Structured Investment Vehicles

Pros:

- High return potential through yield arbitrage.

- Diversification opportunities for investors.

- Access to high-quality, long-term assets.

Cons:

- Vulnerability to market and liquidity risks.

- Complex structures require specialized knowledge.

- Exposure to systemic risks during financial turmoil.

How to Invest in Structured Investment Vehicles

If you’re considering SIVs, here are steps to get started:

- Research Sponsors: Identify reputable financial institutions managing SIVs.

- Understand Investment Terms: Review the prospectus to understand risk and return profiles.

- Consult Financial Advisors: Seek expert guidance to align SIV investments with your financial goals.

Common Misconceptions About Structured Investment Vehicles

- SIVs Are Risk-Free: High returns come with significant risks.

- Only Large Investors Can Participate: SIVs are accessible to a range of investors, depending on regulations.

- SIVs and SPVs Are the Same: While similar, they differ in purpose and structure.

Conclusion

Structured investment vehicles represent a unique financial innovation with potentially high returns but significant risks. Investors and financial professionals can make informed decisions by understanding their structure, advantages, and pitfalls. As financial markets evolve, the role of SIVs may adapt to meet the demands of a changing economic landscape.

FAQs

What is the primary purpose of a structured investment vehicle?

SIVs aim to generate profit through interest-rate arbitrage by borrowing at short-term rates and investing in long-term assets.

How do SIVs maintain liquidity?

They rely on issuing short-term commercial papers and medium-term notes to fund operations.

Are structured investment vehicles still used today?

While their use has declined, SIVs remain a part of structured finance in specific contexts.

What caused SIVs to fail during the financial crisis?

A lack of liquidity and declining asset values led to widespread SIV collapses during the 2007–2008 crisis.

How do SIVs differ from mutual funds?

Unlike mutual funds, SIVs leverage short-term borrowing to invest in long-term assets, making them riskier.

Can individual investors invest in structured investment vehicles?

Yes, institutional and individual investors can participate depending on regulations and the specific SIV.

What lessons were learned from the SIV collapse?

The importance of transparency, liquidity management, and regulatory oversight became evident post-crisis.

BUSINESS7 months ago

BUSINESS7 months agoService Top: Understanding Role, Dynamics, and Consent in Relationships

TECHNOLOGY6 months ago

TECHNOLOGY6 months agoSSIS 858: Everything You Need to Know

GUIDE5 months ago

GUIDE5 months agoLookmovie2.to Legit: A Detailed Review of Safety and Features

FASHION6 months ago

FASHION6 months agoDIY Tips to Customize Your Orange Prom Dress and Stand Out

GUIDE5 months ago

GUIDE5 months agoTokybook: Your Gateway to the World of Audiobooks

TECHNOLOGY6 months ago

TECHNOLOGY6 months agoUnderstanding Libgen: The Ultimate Free Ebook Library

GUIDE7 months ago

GUIDE7 months agoLeague of Graphs: The Ultimate Guide to League of Legends Stats and Analysis

GUIDE6 months ago

GUIDE6 months agoLook at All Those Chickens: The Story Behind the Viral Meme